India has begun reducing its imports of Russian crude oil under pressure from the United States and other Western nations. As a result, public sector oil companies have already started cutting back on purchases, signaling a shift in New Delhi’s energy strategy.

The reductions began even before U.S. President Donald Trump suggested possible tariffs on India for continuing energy deals with Russia. In fact, recent data shows India imported 1.6 million barrels per day of Russian oil in July 2023. This marked a 24% decline from June and a 23.5% drop compared with July 2022. Moreover, trade experts say Indian refiners have stopped signing new contracts with Moscow, even though Russian crude had been a major part of India’s oil supply for the past three years.

Trump recently commented, “Well, I understand India is no longer going to be buying oil from Russia. That’s what I heard. I don’t know if that’s right or not, but that’s a good step. We’ll see what happens.” Consequently, his remarks highlight the growing attention paid to India’s energy choices by global powers.

India is the world’s third-largest consumer of oil and relies on imports for more than 85% of its needs. Furthermore, Foreign Ministry spokesperson Randhir Jaiswal said that India makes purchase decisions based on market prices and the international situation. However, analysts note that refiners are reconsidering Russian oil not only for financial reasons but also due to geopolitical realities.

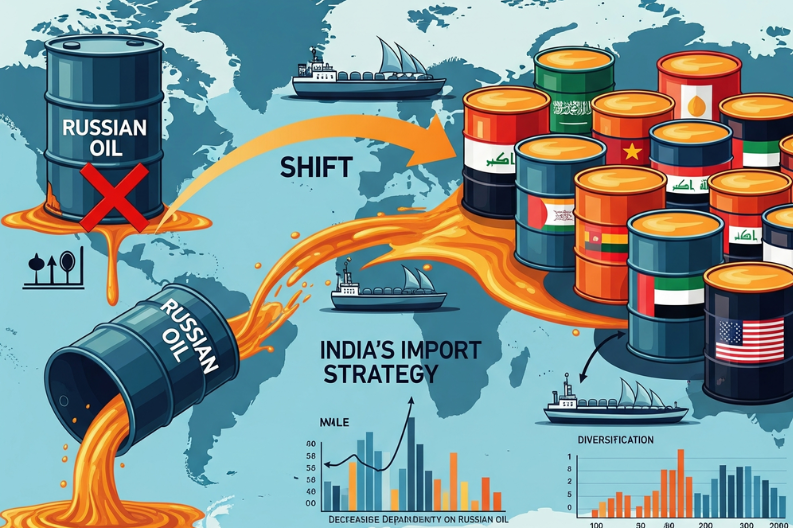

Between July 2022 and July 2023, Russia’s share of India’s oil imports fell from 44.5% to 33.8%. To fill the gap, India increased purchases from Iraq, Saudi Arabia, the United Arab Emirates, the United States, Nigeria, and Kuwait. Meanwhile, Western nations are trying to isolate Russia economically in response to its war in Ukraine, using sanctions and diplomatic pressure to reduce Moscow’s oil revenues.

The transition is not simple. On one hand, Petroleum Minister Hardeep Singh Puri said India faces no direct pressure, noting that the country has expanded its supplier base from 27 to about 40 nations. On the other hand, replacing Russian oil comes with challenges. Russian crude has been available at discounted rates and suits the needs of many Indian refineries. In contrast, alternatives from West Asia and other regions may prove more expensive or less compatible.

Analysts expect that a significant reduction in Russian supplies will take several months. Therefore, they suggest a transition period of three to four months as refiners adjust contracts and supply chains. Nevertheless, a full withdrawal from Russian crude would raise import costs, especially if global oil prices climb further.

In conclusion, India’s evolving strategy shows the balance it must strike between affordable energy and geopolitical realities. With the global oil market volatile, New Delhi will need to adapt quickly to protect its energy security while also managing diplomatic pressure.