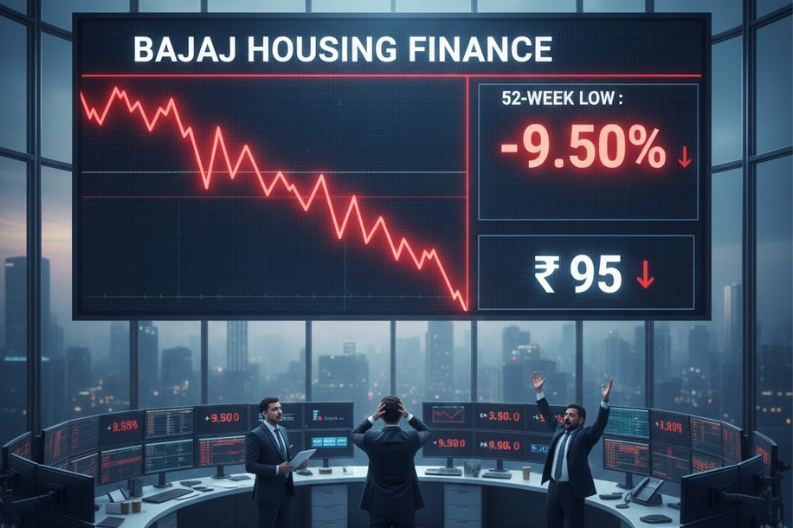

The Bajaj Housing Finance share price suffered a dramatic fall on December 2, dropping over 9% to hit a new 52-week low of ₹95. This sharp decline came after promoter Bajaj Finance announced plans to sell up to 2% of its stake in the housing finance company.

Why the Stock Crashed?

Bajaj Finance currently holds 88.7% of Bajaj Housing Finance’s total equity. However, SEBI regulations require listed companies to maintain at least 25% public shareholding. Therefore, the parent company decided to offload part of its stake to comply with these norms.

Key Deal Details:

| Aspect | Details |

|---|---|

| Stake Being Sold | Up to 2% (16.66 crore shares) |

| Deal Value | Approximately ₹1,580-₹1,890 crore |

| Floor Price | ₹95 per share |

| Discount | 9.6% below previous close |

| Sale Period | December 2, 2025 to February 28, 2026 |

| Merchant Banker | IIFL Capital Services Ltd. |

Moreover, the block deal involved selling shares at a significant discount to the previous closing price of ₹104.59. Consequently, this spooked investors and triggered panic selling.

Stock Performance Analysis: The company’s journey since its IPO has been extremely volatile. Initially, shares opened around ₹70 and surged past ₹190 at their peak. Nevertheless, the recent sell-off has erased nearly half those gains.

#BajajHousingFinance came out with an IPO at Rs 70

Immediately after listing price was ramped upto Rs 190 in which many retail investors got trappedNow the promoter entity Bajaj Finance is selling stake at half of that price ~Base Price Rs 95 to trim its stake, a price below… pic.twitter.com/74GpQHtq8K

— sandip sabharwal (@sandipsabharwal) December 1, 2025

Current Market Status:

- 52-week low: ₹95

- Previous close: ₹104.59

- 12-month decline: 28.67%

- Year-to-date fall: 24.59%

- Trading volume: 3.47 times the 30-day average

Furthermore, the relative strength index stood at 34.50, indicating the stock entered oversold territory.

Analyst Recommendations: Market analysts remain divided on the stock’s future prospects. According to Bloomberg data:

- Buy rating: 2 analysts

- Hold rating: 3 analysts

- Sell rating: 6 analysts

- Average target price: ₹111.10 (implies 16.6% upside)

Thus, most analysts suggest caution before investing in the stock.

Company’s Financial Performance: Despite the market turbulence, Bajaj Housing Finance showed strong quarterly results. In Q2 FY26, the company reported:

Financial Highlights:

| Metric | Q2 FY26 | Growth |

|---|---|---|

| Profit After Tax | ₹642.96 crore | 18% YoY |

| Net Interest Income | ₹956 crore | 34% YoY |

| Gross NPA | 0.26% | Improved by 3 bps |

| Net NPA | 0.12% | Stable |

Additionally, the net interest margin stood at 4%, showing healthy profitability. The company’s asset quality also improved compared to last year.

What Investors Should Watch?

Several factors will influence the stock’s future movement:

- Additional stake sales: More promoter selling could pressure prices further

- Quarterly results: Future financial performance will be crucial

- Interest rate changes: NBFC stocks are sensitive to rate movements

- Public shareholding compliance: Progress toward 25% public float

- Housing finance sector trends: Overall demand for home loans

Meanwhile, the remaining promoter equity faces a 60-day lock-in period after this sale.

The Bajaj Housing Finance share price remains under pressure as investors digest the promoter stake sale and await clarity on the company’s long-term growth trajectory.