AI is undeniably the most transformative technology of our generation. Companies worldwide are racing to build larger models, faster chips, and massive data centres-hoping to capture the next trillion-dollar opportunity. But in this excitement, a silent risk is brewing beneath the surface: the formation of an AI bubble in the United States.

And the big question Indian investors are asking:

“If this bubble bursts, will the Indian stock market crash?”

Let’s break it down in a simple, structured, and neutral way.

The Reality: AI is Good, Financial Engineering is Not

Global AI spending is expected to cross $1.5 trillion in 2025, which sounds massive, but relative to a $100 trillion global GDP, it’s only around 1.5%. AI as a technology is transformational and absolutely worth investing in.

The concern is not AI itself, but the way companies are funding AI growth.

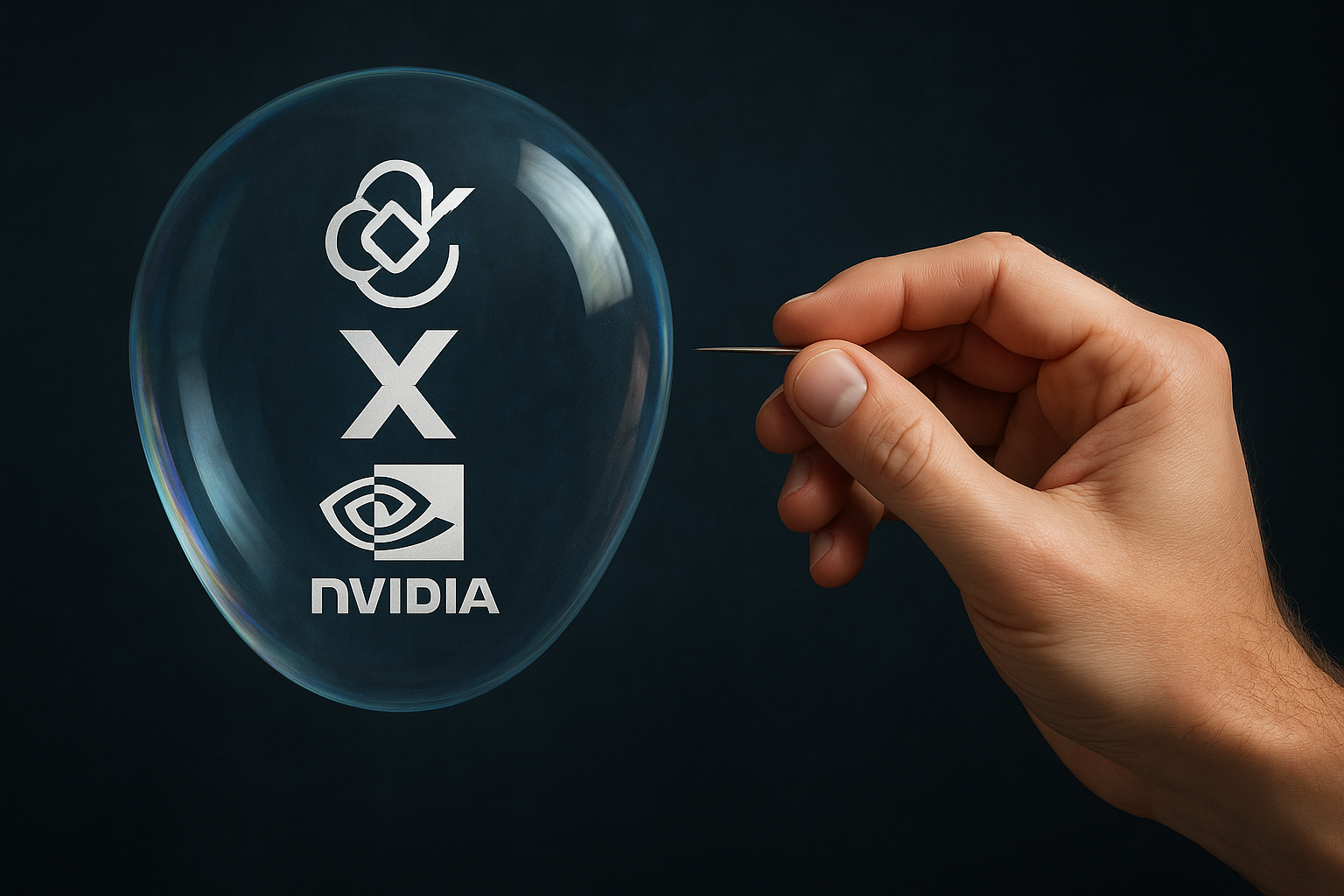

A dangerous mix of circular financing, hidden debt, SPVs, and geopolitical supply constraints is inflating demand for AI chips and data centres-creating conditions similar to historical bubbles.

(Examples explained in your reference doc: Nvidia-OpenAI circular financing, AMD warrants, CoreWeave, SPV structures used by xAI, etc.)

Why This Looks Like a Bubble?

1. Circular Revenue Loops

Companies are investing in each other and then using the same money to buy products from each other.

- Nvidia invests in AI startups → startups buy Nvidia GPUs → Nvidia reports higher sales → Nvidia’s market cap rises.

This creates inflated demand that doesn’t always represent organic customer needs.

2. Massive Debt Hidden Behind SPVs

AI data centres require billions of dollars of chips, electricity, land, cooling, and servers.

So companies are forming Special Purpose Vehicles (SPVs) to raise debt off their books.

This hides risk from investors and makes balance sheets look artificially clean.

Exactly this pattern has been seen before-in 2008’s synthetic CDO cycle and the 2000 dot-com bubble.

3. Betting on Depreciating Hardware

Unlike real estate in 2008, GPUs lose value very fast.

Rental rates for AI chips have already dropped up to 75% in some markets, implying oversupply and miscalculation.

When debt is built on an asset that is guaranteed to depreciate, systemic risk shoots up.

So Will the AI Bubble Burst?

Bubbles burst when:

- Growth expectations become unrealistic

- Borrowing increases faster than revenues

- Capital expenditure becomes unsustainable

All three are already visible in the US AI ecosystem. The timing is impossible to predict, but historically, markets tend to correct when the gap between expectations and cash flows widens too much.

If the US Market Crashes, Will India Fall Too?

According to Rohit Tripathi, yes, India will face a decline if the AI bubble bursts, as he explained in detail in his AI Bubble Explained video on YouTube.

But for now, let’s understand why this impact would mostly be short-term.

Here’s why:

1. Global Sentiment Is Linked

Whenever the US-especially tech-falls, global markets respond.

2020, 2008, 2001…. this pattern has repeated multiple times.

2. FII Ownership in Indian Markets Is Significant

Foreign investors withdraw money during global panic to cover losses in the US or to rebalance portfolios.

This directly hits Nifty, Bank Nifty, large-caps, and high-beta midcaps.

3. Indian IT & New-Age Tech Are Directly Connected

If the US cuts tech spending:

- Indian IT services will see a slowdown

- Startup funding may freeze

- Outsourcing budgets may shrink

- Export-oriented tech, chemicals, and manufacturing may feel the pressure

4. Global Risk-Off = India Risk-Off

India is the fastest-growing economy, but still part of the global financial system.

A US bubble burst creates a chain reaction.

Will India Crash as Badly as the US?

No. India is far more resilient today.

Reasons:

- Strong domestic consumption

- Structural reforms (GST, UPI, infra push)

- Manufacturing revival (PLI)

- Clean banking system

- Rising retail participation

- Government-led capex cycle

India may correct 15-25%, but a US AI meltdown won’t destroy the long-term India story.

How Should Investors Protect Themselves?

1. Have an Emergency Fund

At least 6-12 months of expenses in liquid assets.

2. Shift 30-50% SIP Allocation to Debt for Now

FDs, debt mutual funds, government bonds.

This becomes your opportunity fund if a crash comes.

3. Learn Hedging

PUT options, covered calls, or inverse ETFs (for international portfolio hedging).

An investor who knows how to hedge is always safer.

4. Avoid High-Valuation, Story-Based Stocks

Anything without earnings + high debt = danger.

5. Continue SIPs – Do NOT Stop

Corrections are blessings for long-term investors.

Conclusion

AI will transform the world. It will create new industries, new jobs, and new wealth.

But the financial engineering behind AI investments in the US is unsustainable, and whenever a bubble is built on leverage, it eventually bursts.

If the American AI bubble breaks, Indian markets will fall-but India’s fundamentals ensure it will recover faster and stronger.

The smartest thing an Indian investor can do today? Prepare, hedge, stay allocated to debt, and wait for opportunities.

“Knowledge + risk management = survival + wealth creation.”