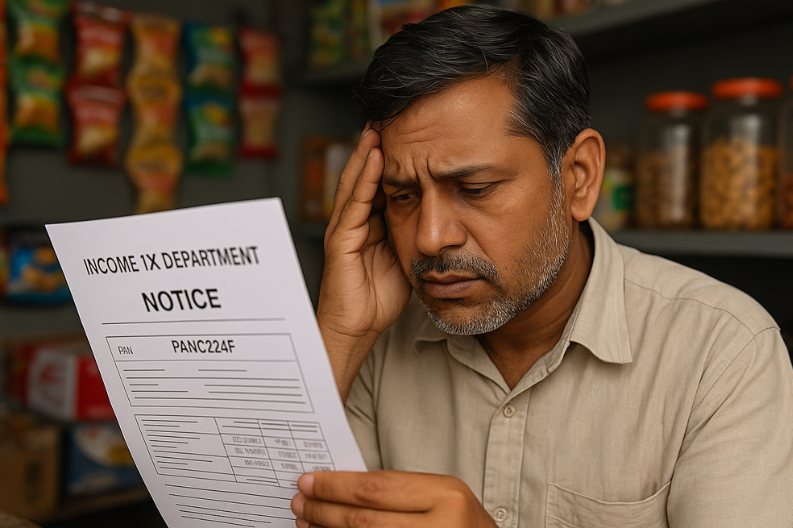

In Bulandshahr, Uttar Pradesh, a shocking case of identity theft has come to light. Sudhir, a small grocery store owner from the Nayaganj area of Khurja, was stunned when he received a tax notice claiming that six companies had been registered in his name in Delhi, with sales exceeding ₹141 crore. Despite running only a modest grocery shop, Sudhir found himself accused of massive financial dealings he had no knowledge of.

This was not the first time Sudhir faced such trouble. In 2022, he had already received a similar tax notice, which he thought was resolved. However, on July 10 this year, he was hit again with another alarming notice, adding to his stress and confusion. “I have no ties to these firms. I simply run my grocery store,” Sudhir stated in shock.

The local police have now stepped in to investigate the matter seriously. Station In-charge Pankaj Rai confirmed that an inquiry is underway, focusing on how Sudhir’s PAN card details might have been misused to set up fake companies. PAN card fraud has been on the rise across India, with many innocent people becoming victims of identity theft.

The scale of the problem is significant. In 2021, the Income Tax Department uncovered more than three lakh cases of PAN card misuse nationwide. To combat this, the government has made it mandatory to link PAN cards with Aadhaar, a step aimed at reducing fraud and improving tax transparency. Yet, loopholes remain, and fraudsters continue to exploit them.

Khurja’s proximity to major trade hubs like Punjab makes it a target for such scams. Criminals often exploit personal details to register fake firms for financial gain. Experts warn that citizens need to be vigilant. Regularly checking credit reports, linking PAN with Aadhaar, being cautious with sharing personal information, and reporting suspicious activity are some key steps to safeguard against fraud.

India’s legal framework, including the Income Tax Act and Aadhaar Act, lays out penalties for financial fraud and identity theft. However, lack of awareness among ordinary citizens makes many vulnerable.

Sudhir’s ordeal is a reminder of the serious impact of such crimes. While the police work to resolve his case, it underscores the need for greater awareness and vigilance. Fraudulent misuse of financial documents is not just a bureaucratic hassle—it can cause immense stress and falsely implicate innocent people.