The income tax portal allows taxpayers to correct mistakes made while filing their Income Tax Return (ITR). Many people make errors during the initial filing process, ranging from minor calculation mistakes to significant omissions like missing income or incorrect deductions. Fortunately, the system provides an opportunity to file a revised return under Section 139(5) of the Income Tax Act, 1961.

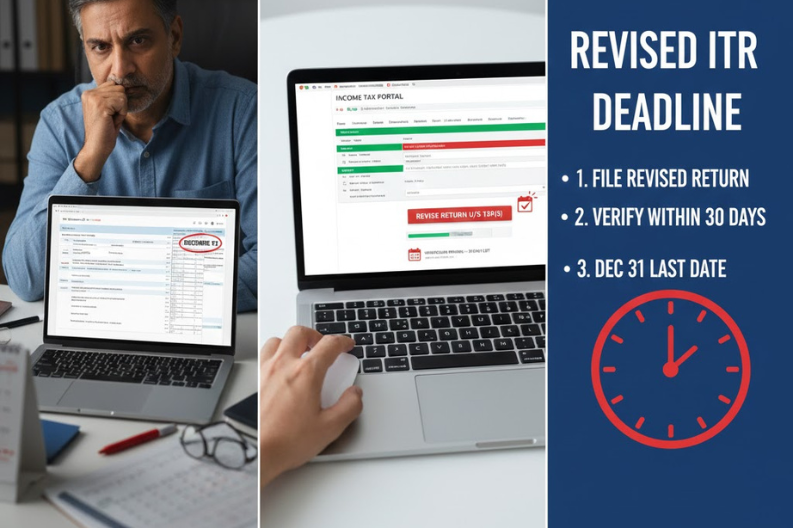

However, taxpayers who filed their ITRs on September 16, 2025, for Assessment Year 2025-26 must remember that December 31, 2025, is the final deadline to submit a revised return.

Common Mistakes That Require Revision

| Error Type | Examples |

|---|---|

| Income Issues | Omitted, reduced, or exaggerated income |

| Deductions | Claimed excess or missed deductions |

| Calculations | Mathematical errors in tax computation |

| Form Selection | Chosen wrong ITR form |

| Refund Claims | Claimed less refund than eligible |

Additionally, taxpayers may need to revise returns if they selected the wrong tax regime or missed necessary disclosures.

Must You Verify Revised Returns?

Verification of a revised ITR is mandatory in all cases. Furthermore, if you file a revised return but fail to verify it within 30 days, the Income Tax Department treats it as invalid. Consequently, your revised return will be deemed never to have been filed.

Even if you verified your original ITR, you must separately verify the revised return. Moreover, each revised return requires independent verification, regardless of how many times you revise.

“The Income Tax Department will not process the revised return unless the verification is completed within the prescribed time,” experts confirm.

How to File Revised Returns

Step-by-Step Process:

- Log in to your account on the income tax portal or tax filing platform

- Navigate to ‘My Tax Returns’ section

- Select the return you want to revise

- Click ‘Mark your ITR as revised’

- Make necessary changes in respective sections

- Proceed to e-file the revised return

- Verify within 30 days of filing

If you filed your original return through a different platform, you can still use any tax filing service to submit your revised return. Simply enter the original filing date and acknowledgment number to begin the revision process.

Important Points to Remember

Key Facts:

- Last date: December 31 of the assessment year

- Multiple revisions: Allowed with no penalties

- Belated returns: Can also be revised

- No penalty: For filing revised returns

- Complete replacement: Revised return replaces the original entirely

Therefore, even if you received a refund after processing your original return, you can still file a revised return within the deadline.

What Happens If You Don’t Verify?

If your revised return remains unverified, only the original return stays valid. Meanwhile, all changes made in the revised filing will not be considered. Consequently, the Income Tax Department will make decisions based on your original authenticated return only.

Belated Returns and Penalties

If you missed the original July 31 deadline, you can still file a belated return by December 31, 2025. However, you must pay a late fee under Section 234F, which can be up to Rs. 5,000 depending on your income level.

Nevertheless, there is no separate penalty for filing a revised return itself.

The income tax portal makes it convenient for taxpayers to correct mistakes and ensure accurate tax filings. Remember to verify your revised return within 30 days to avoid invalidation and potential complications with the Income Tax Department.